Global Financial Stability Report

A Bumpy road ahead, April 2018

The April 2018 Global Financial Stability Report (GFSR) finds that short-term risks to financial stability have increased somewhat since the previous GFSR. Medium-term risks are still elevated as financial vulnerabilities, which have built up during the years of accommodative policies, could mean a bumpy road ahead and put growth at risk. Higher inflation may lead central banks to respond more aggressively than currently expected, which could lead to a sharp tightening of financial conditions. Valuations of risky assets are still stretched, and liquidity mismatches, leverage, and other factors could amplify asset price moves and their impact on the financial system.

Emerging markets have generally improving fundamentals, but could be vulnerable to sudden tightening of global financial conditions. Banks have strengthened their balance sheets since the crisis, but parts of the system face a structural US dollar liquidity mismatch that could be a vulnerability.

Crypto assets have features that may improve market efficiency, but they could also pose risks if used with leverage or without appropriate safeguards. Policymakers and investors must remain attuned to the risks of rising interest rates and higher market volatility. Central banks should continue to normalize policy gradually and communicate clearly, while policymakers should address vulnerabilities by deploying and developing macroprudential tools.

This GFSR also examines the short- and medium-term implications for downside risks to growth and financial stability of the riskiness of corporate credit allocation. It documents the cyclical nature of the riskiness of corporate credit allocation at the global and country levels and its sensitivity to financial conditions, lending standards, and policy and institutional settings.

Another chapter analyzes whether and how house prices move in tandem across countries and major cities around the world—that is, global house price synchronicity. The chapter finds a striking increase in house price synchronization across the countries and cities. It also finds that global financial conditions contribute to this synchronization, which suggests that policymakers should be alert to the possibility that shocks to house prices elsewhere may affect housing markets at home. Full Report

World Economic Outlook

Cyclycal upswing, structural change, April 2018

The global economic upswing that began around mid-2016 has become broader and stronger. This new World Economic Outlook report projects that advanced economies as a group will continue to expand above their potential growth rates this year and next before decelerating, while growth in emerging market and developing economies will rise before leveling off.

For most countries, current favorable growth rates will not last. Policymakers should seize this opportunity to bolster growth, make it more durable, and equip their governments better to counter the next downturn. Full Report

Fiscal Monitor

Capitalizing on good times, april 2018

The April 2018 edition of Fiscal Monitor is focused on two broad themes: the burden of high global debt and the opportunities and challenges of digital government.

The report explores how strong and broad-based growth provides an opportunity to rebuild fiscal buffers now, improve government balances, and anchor public debt. One concern is the surge in global debt, which reached the record peak of US$164 trillion in 2016. The report discusses how public debt plays an important role in the surge in global debt, which is at historic highs among advanced and emerging market economies. Rapidly rising debt among low income developing countries means that interest payments are taking up an increasingly large share of taxes and expenditure.

The report recommends putting deficits and debt firmly on a downward path toward their medium-term targets. The size and pace of adjustment need to be calibrated to each country’s cyclical conditions and available fiscal space. Several low-income countries need to mobilize revenues, rationalize spending, and improve spending efficiency. The report also urges countries to implement policies to support medium-term growth by promoting human and physical capital, and by increasing productivity.

The report discusses how digitalization presents opportunities and challenges for fiscal policy and the ways in which it can change how governments design and implement current and future policies. The report also discusses how digitalization can positively transform governments by improving tax policy and administration, increasing spending efficiency and enhancing fiscal management.

Digitalization calls for a proactive, forward-looking, and comprehensive reform agenda. The report conveys that governments must address multiple political, social, and institutional weaknesses and manage digital risks. Digitalization is already an overwhelming trend that will accelerate further. Governments should embrace it, foresee it, and shape it. Full Report

Asia Pacific: good times, uncertain times: a time to prepare, May 2018

The world economy continues to perform well, with strong growth and trade, rising but still muted inflation, and accommodative financial conditions, not withstanding some increased financial market volatility in early 2018. Driven partly by the procyclical tax stimulus in the United States, near-term economic prospects for both the world and Asia have improved from the already favorable outlook presented in October 2017.

Asia is expected to grow by around 5½ percent this year, accounting for nearly two-thirds of global growth, and the region remains the world’s most dynamic by a considerable margin. But despite the strong outlook, policymakers must remain vigilant. While risks around the forecast are broadly balanced for now, they are skewed firmly to the downside over the medium term.

Key risks include further market corrections, a shift toward protectionist policies, and an increase in geopolitical tensions. With output gaps closing in much of the region, fiscal policies should focus on ensuring sustainability. Given still moderate wage and price pressures, monetary policies can remain accommodative in most Asian economies for now, but central banks should stand ready to adjust their stances as inflation picks up, and macroprudential policies should be used appropriately to contain credit growth.

Many Asian economies face important medium-term challenges, including population aging and declining productivity growth, and will need structural reforms, complemented in some cases by fiscal support. Finally, the global economy is becoming increasingly digitalized, and some of the emerging technologies have the potential to be truly transformative, even as they pose new challenges. Asia is already a leader in many aspects of the digital revolution, but to remain at the cutting edge and reap the full benefits from technological advances, policy responses will be needed in many areas, including information and communication technology, trade, labor markets, and education. Full Report

europe: managing the upswing in uncertain times, may 2018

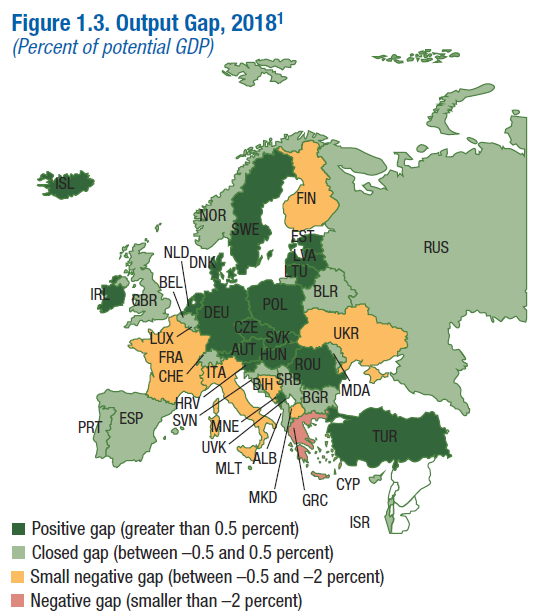

Sources: IMF, World Economic Outlook; and IMF staff calculations.

Note: Data labels in the figure use International Organization for Standardization (ISO) country codes.

1 Output gaps reflect IMF country desks’ estimates.

Europe continues to enjoy strong growth. Activity has firmed up in many economies, and the forecast is for more of the same. Real GDP increased by 2.8 percent in 2017, up from 1.8 percent in 2016. The expansion is largely driven by domestic demand. Credit growth has finally picked up, which is helping Europe’s banks rebuild profitability. While leading indicators have recently begun to ease, they remain at high levels. Accordingly, the forecast is for growth to stay strong, reaching 2.6 percent in 2018 and declining to 2.2 percent in 2019. Amid the good times, however, fiscal adjustment and structural reform efforts are flagging.

Inflation and wage growth remain subdued in most advanced economies and are projected to gather pace only very gradually, given slack in labor markets.

In central and eastern Europe, by contrast, where economies are cyclically much further ahead, wages are growing rapidly and inflation is expected to pick up appreciably in 2018, potentially affecting competitiveness.

As the report discusses, the subdued wage dynamics in many advanced economies reflect low inflation and inflation expectations, still-high unemployment and underemployment rates, as well as sluggish productivity growth.

In addition, there are signs that wage Phillips curves are very flat in advanced economies and that spillovers from regional labor market conditions and slow wage growth in some economies are contributing to wage moderation, holding back demand in other economies. It could thus take some time before wage growth picks up noticeably and broadly in the advanced economies. Full Text

Middle East: outlook for oil prices highly uncertain, stronger euro area prospects beneficial, may 2018

Stronger prospects for the euro area should benefit the Middle East, North Africa, Afghanistan, and Pakistan (MENAP) region, especially oil importers, through higher exports. The region should also benefit from a marginal

strengthening of the outlook for China, a key partner for the region.

However, the global outlook also entails higher global interest rates as monetary policy continues to normalize in advanced economies. This could increase fiscal vulnerabilities and tighten credit conditions in the MENAP

region, especially if the risk that global financial conditions tighten more than expected materializes.

The outlook for oil prices remains highly uncertain, largely reflecting supply-side uncertainty. Oil prices grew strongly in the second half of 2017, rising above $65 a barrel in January, supported by the improved global growth outlook, extension of the OPEC+ agreement (limiting oil production through the end of 2018), unplanned outages, and geopolitical tensions.

More recently, with rapidly rising US shale production, the price of oil has edged down. In this context, while the oil price assumptions for 2018 and 2019 have been revised upward relative to the October 2017 report, the medium-term outlook for oil prices remains subdued. Full Report

Research provided by the International Monetary Fund (IMF)

All photography by Jared Chambers