global House price synchronicity, april 2018

House Price Synchronicity: A Conceptual Framework

House prices may move in tandem across countries and major cities because of synchronous supply and demand factors. Supply‑side considerations include the costs of construction and land acquisition. On the demand side, demographics, tax and other policy considerations, and depreciation and maintenance play a role. Financial factors, such as the mortgage interest rate, the risk premium on assets with similar risk characteristics as housing, household leverage, and the expected nominal house price appreciation rate, also matter. Full Report

Economies Differ in Their House Price Interconnectedness

Note: The figure is based on a vector autoregression of house price growth rates (quarter over quarter), controlling for global factors, from a sample covering 1990:Q1

to 2016:Q4. Node size is based on an economy’s total outward spillovers.

Pink nodes represent advanced economies, and blue nodes represent emerging market economies. Arrow thickness is based on link distribution. Only links above the

50th percentile are considered.

Interconnectedness among Cities’ House Prices Varies

Note: The figure is based on a vector autoregression of city-level house price growth rates (quarter over quarter), controlling for global factors, spanning 2004:Q1 to

2017:Q2. Node size is based on the city’s total outward spillovers. Pink nodes represent advanced economies, and blue nodes represent emerging market economies. Arrow thickness is based on link distribution. Only links above the 66th percentile are considered.

Ack = Auckland; Ams = Amsterdam; Bgt = Bogotá; Brl = Berlin; Brs = Brussels; Dbl = Dublin; Dub = Dubai; HKG = Hong Kong SAR; Hls = Helsinki; Jkr = Jakarta; Lim = Lima; Lnd = London; Mdr = Madrid; Mmb = Mumbai; Mnl = Manila; Msc = Moscow; MxC = Mexico City; NYC = New York City; Osl = Oslo; Prs = Paris; Rom = Rome; Sel = Seoul; SGP = Singapore; Shn = Shanghai; Snt = Santiago; Stc = Stockholm; Syd = Sydney; Tky = Tokyo; Trn = Toronto; Vnn = Vienna.

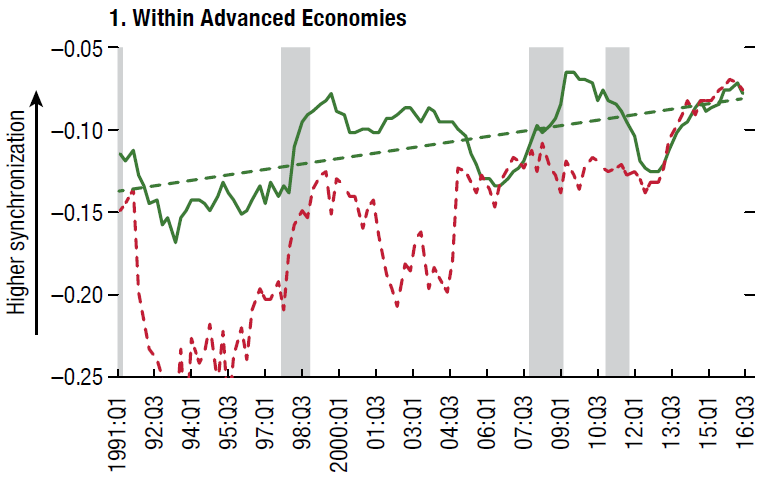

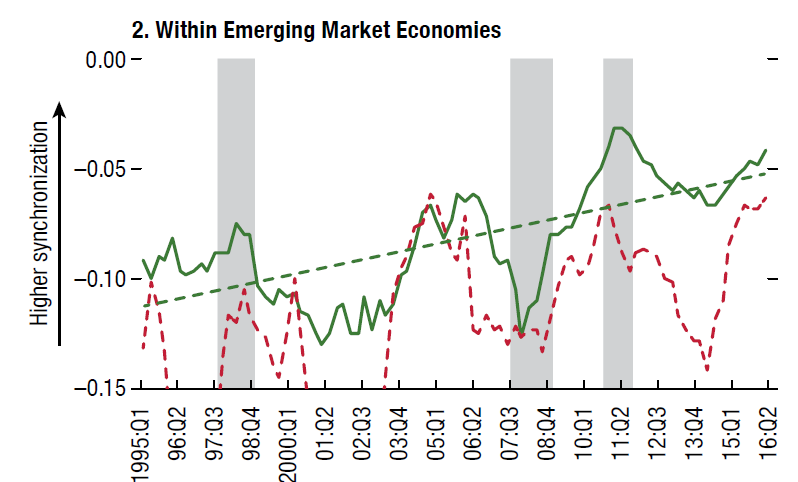

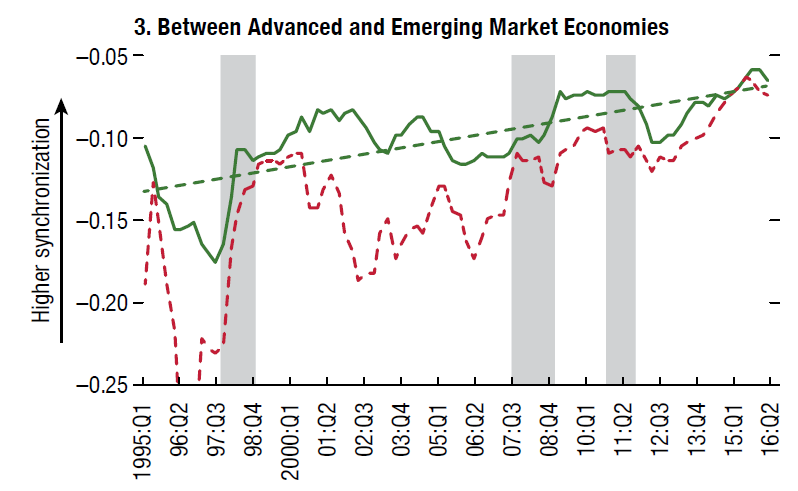

Synchronization Has Steadily Increased across Countries and Cities

HOUSE PRICE SYNCHRONIZATION: WHAT ROLE FOR FINANCIAL FACTORS?

Rising house prices have been a feature of the economic recovery in many countries since the global financial crisis. But recent increases have also been occurring in an accommodative monetary policy environment

in many advanced economies, raising the specter of financial instability should financial conditions reverse and simultaneously lead to a decline in house prices.

This report analyzes whether and how house prices move in tandem across countries and major global cities; that is, the synchronicity of global house prices. On the one hand, higher house price synchronization and deeper

global links in housing markets may be beneficial. On the other hand, higher synchronization may be the result of global financial conditions influencing local house price dynamics and housing markets, thereby propagating local

economic and financial shocks.

Strikingly, the report finds an increase in house price synchronization, on balance, for 40 countries and 44 major cities in advanced and emerging market economies. The report’s analysis suggests that countries’ and cities’ exposure to global financial conditions may provide an explanation for the increase in house price synchronization. Moreover, cities in advanced economies may be particularly exposed to global financial conditions, perhaps owing to their integration with global financial markets or to their attractiveness for global investors searching for yield or safe assets.

Thus, policymakers cannot ignore the possibility that shocks to house prices elsewhere may affect domestic markets. While house price synchronization in and of itself may not warrant policy intervention, the evidence presented in this report suggests that heightened synchronicity of house prices can signal a downside tail risk to real economic activity, especially when taking place in a buoyant credit environment.

The report finds that macroprudential policies seem to retain some ability to influence local house price developments even in countries with highly synchronized housing markets, and that macroprudential policy measures put in place to tame rising vulnerabilities in a country’s financial sector may have the additional effect of reducing a country’s house price synchronization with the rest of the world. These unintended effects are worth considering when evaluating the trade-offs of implementing macroprudential and other policies. Full Report

All photography by Jared Chambers